Botas De Senderismo De Moda Para Hombres Ligeras Impermeables Resistentes Al Desgaste Antideslizantes Duraderas Cómodas Para Senderismo Acampar Y Exterior | Alta Calidad Y Asequible | Temu Spain

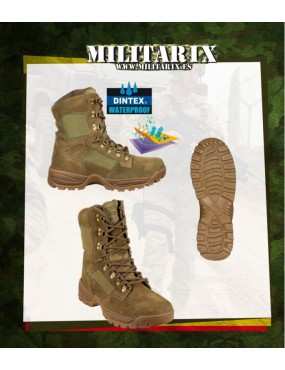

Botas militares de combate para hombre, calzado táctico de ante de vaca, color verde militar, Beige, desierto - AliExpress

BedaPeques Bota Militar piel Charol Verde Botella con Cordones color: Verde talla: 27 : Amazon.es: Moda